A framework to build a diversified private markets portfolio

Professionally-designed strategies intended to help you achieve your long-term investment goals.

Developed in partnership with

|

The power of asset allocation

Successful long-term investing starts with aligning your mix of assets with your investment objectives.

In public markets, stocks and bonds can complement each other, helping to balance risk and return. In the following framework, we apply the same principles to private markets.

Wilshire’s approach

Apply an institutional advisor’s experience to your portfolio

Leveraging best practices gleaned from 50 years of advising the world’s largest investors, we’ve partnered with Wilshire to develop a suite of goals-based private markets portfolios.

Rooted in research

Strategies are derived from Wilshire’s time-tested capital market assumptions process.

Designed to optimize returns

Each strategy is intended to maximize returns at various levels of risk.

Rebalanced annually

Wilshire will update the strategies on an annual basis in alignment with its latest outlook.

Wilshire provides Yieldvilla certain model portfolios covering private equity, private credit and real assets which are expected to be updated on an annual basis. Wilshire does not provide investment advisory services to or otherwise participate in the direct management of a client’s portfolio.

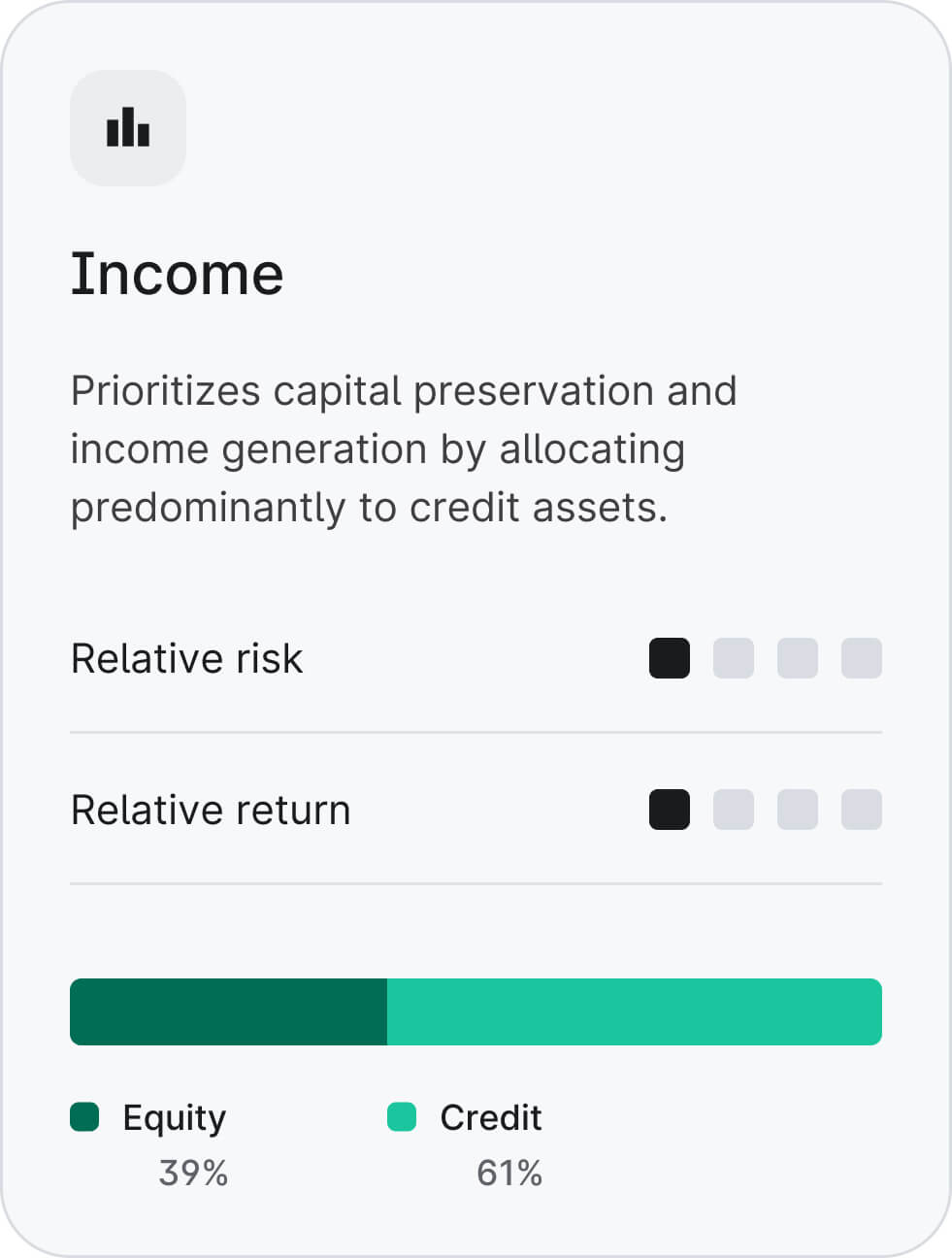

Explore our strategies

Put it into action

How you achieve your target private market allocation is up to you.

Direct

Discover how you can apply this framework to your portfolio of individual investments.

Guided

Our Private Client Group can help benchmark your portfolio and surface opportunities.