1

2

3

Explore investment opportunities

Whether you’re looking to generate income, grow your portfolio’s value, or a combination of both, we offer investments that match these objectives.

Broadest range: We offer more alternative asset classes than any other platform.

Top-tier investment managers: Access institutional-quality investments without institutional costs.

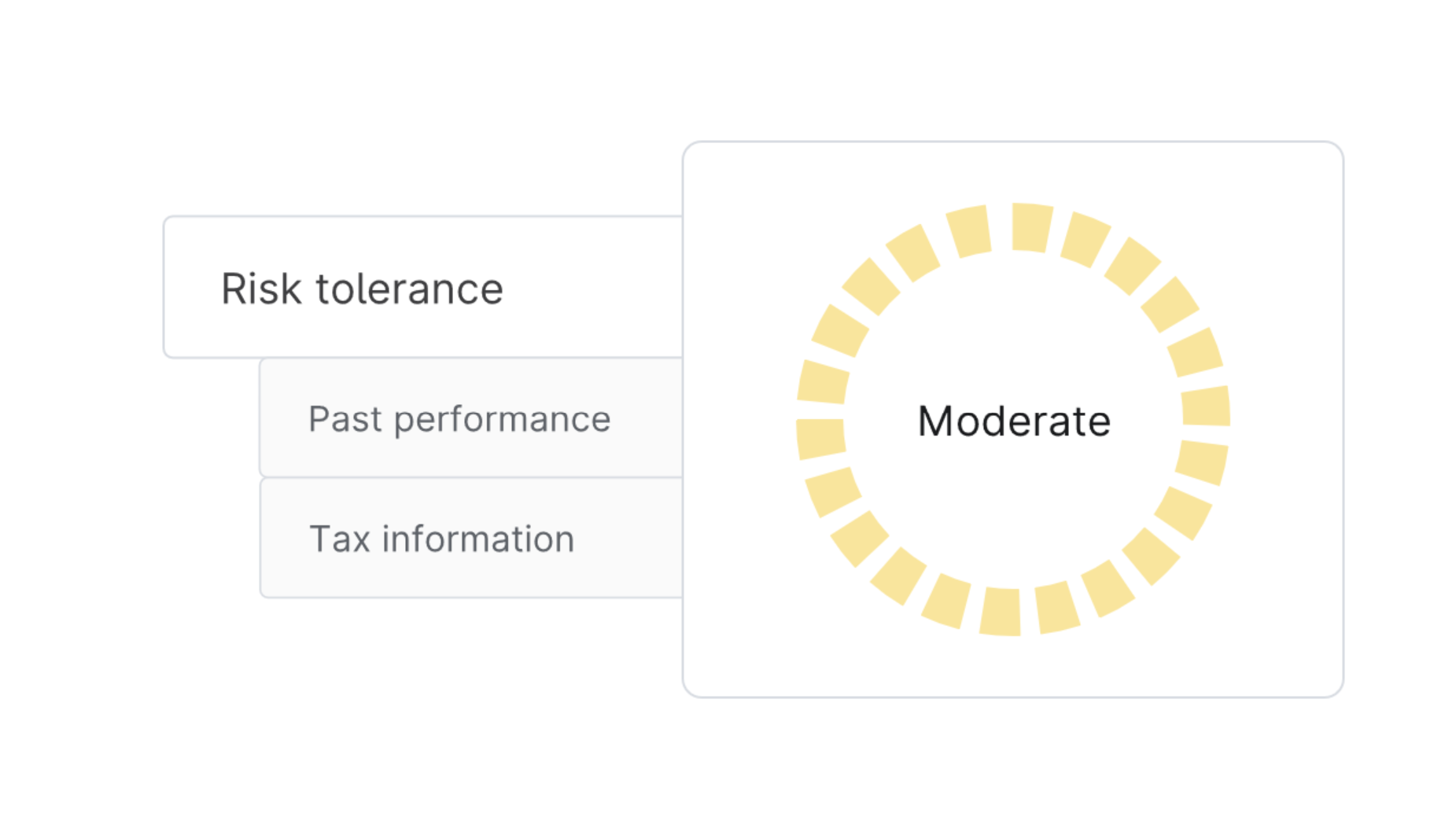

Invest with confidence

From past performance metrics to background on our partners, we aim to provide all the information needed to make an informed decision.

Highly-vetted: All investments pass a four-step due diligence process.

Dedicated support: Our investor relations team is available to answer your questions at any time.

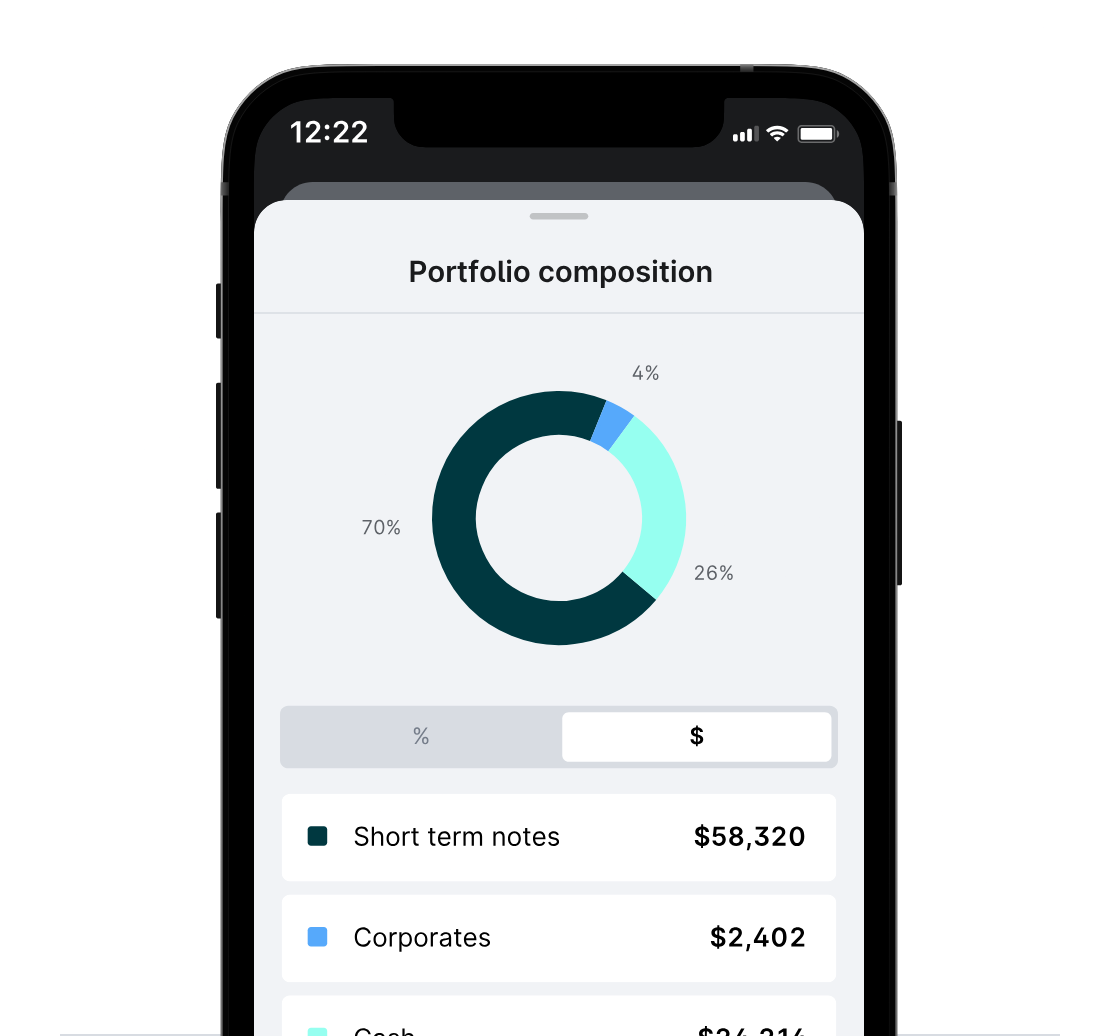

Track your performance and earnings

Investments typically pay regular income, growth at maturity, or a combination of both.

See your performance: We provide regular updates on your investment.

Quick payments: Your returns are deposited into your FDIC-insured Yieldvilla Wallet.

Returns on your returns: Roll your maturing investments directly into a new opportunity.

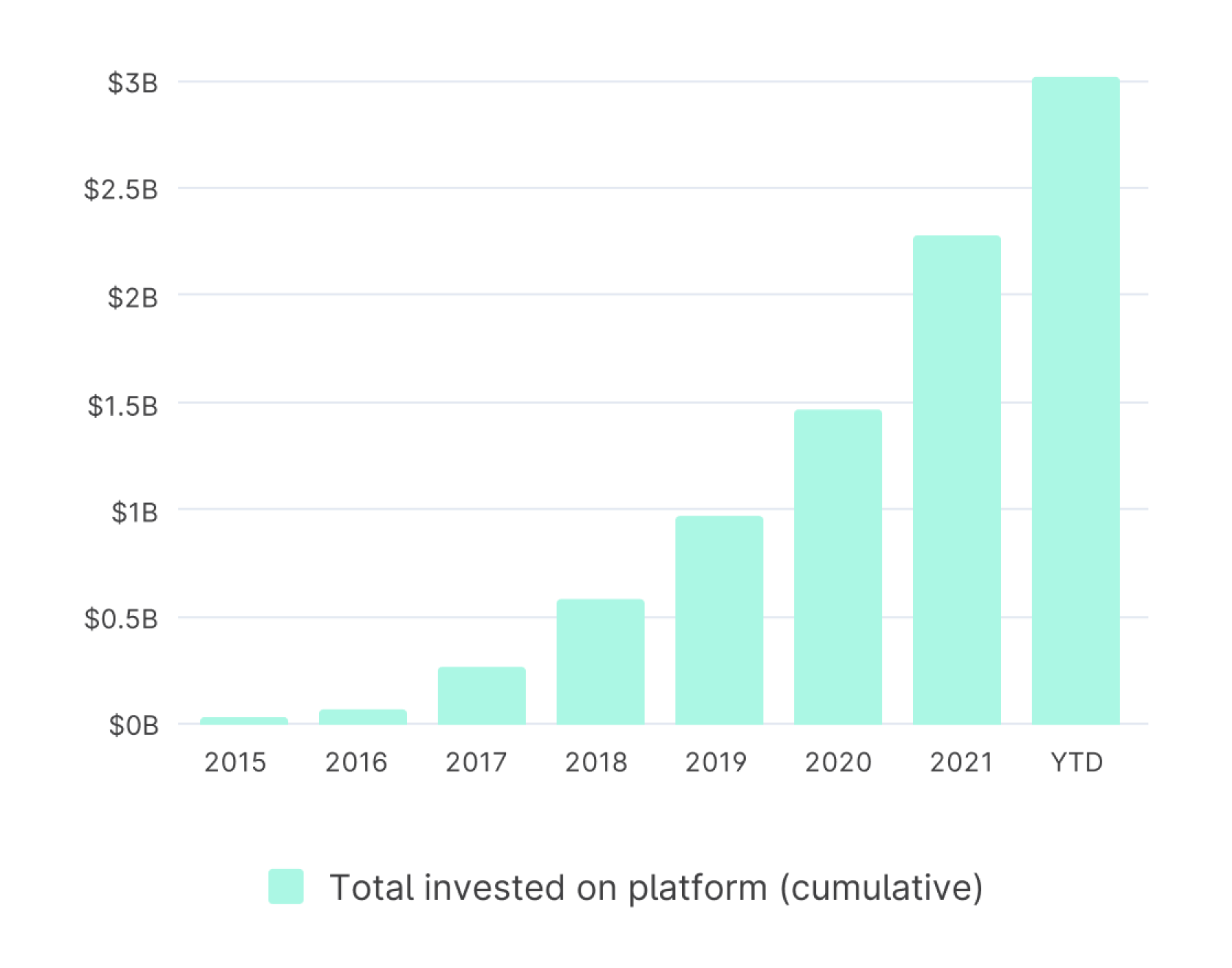

We analyze billions of dollars worth of investments on your behalf

Before an investment reaches your portfolio, our investment team works behind the scenes to bring what we believe are the best possible opportunities to you.

Curate exclusive opportunities

We partner with third-party managers to bring you opportunities normally only available to institutions. We have also developed an extensive network of partnerships with experienced originators.

$34B+

in deal volume reviewed since inceptionHolistic due diligence review

Opportunities are evaluated first by a dedicated team for each asset class. From there, committees unassociated with the opportunity provide a fresh perspective and challenge the investment's thesis to identify any potential risks.

9%

of opportunities we evaluate make it to investorsOngoing monitoring and reporting

Our experienced Portfolio & Risk Management Team constantly monitors your investments, providing regular updates. You can view your portfolio and track your performance at any time on the Yieldvilla app.

90%+

of offerings have performed within 0.5% of their targetsHow much should I allocate to private markets?

Investment managers like BlackRock recommend supplementing your portfolio of stocks and bonds with up to 20% private market alternatives.