Extensive opportunities

We offer more alternative asset classes for IRAs than any other platform — everything from real estate to private credit to crypto.

Support for all major accounts

Roll over a 401(k); transfer all, or a portion of a traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA; or contribute new funding.

Get started in 5 minutes

Most accounts can be funded in just a few days, and our concierge team is here to assist every step of the way.

Take your retirement off autopilot

Your retirement dollars are among the most important to optimize due to their tax efficiencies, making IRAs an ideal vehicle for enhanced private market growth and income.

Protect your wealth

Don’t leave your entire retirement portfolio vulnerable to public market volatility. Diversify with generally lower-correlation private assets.

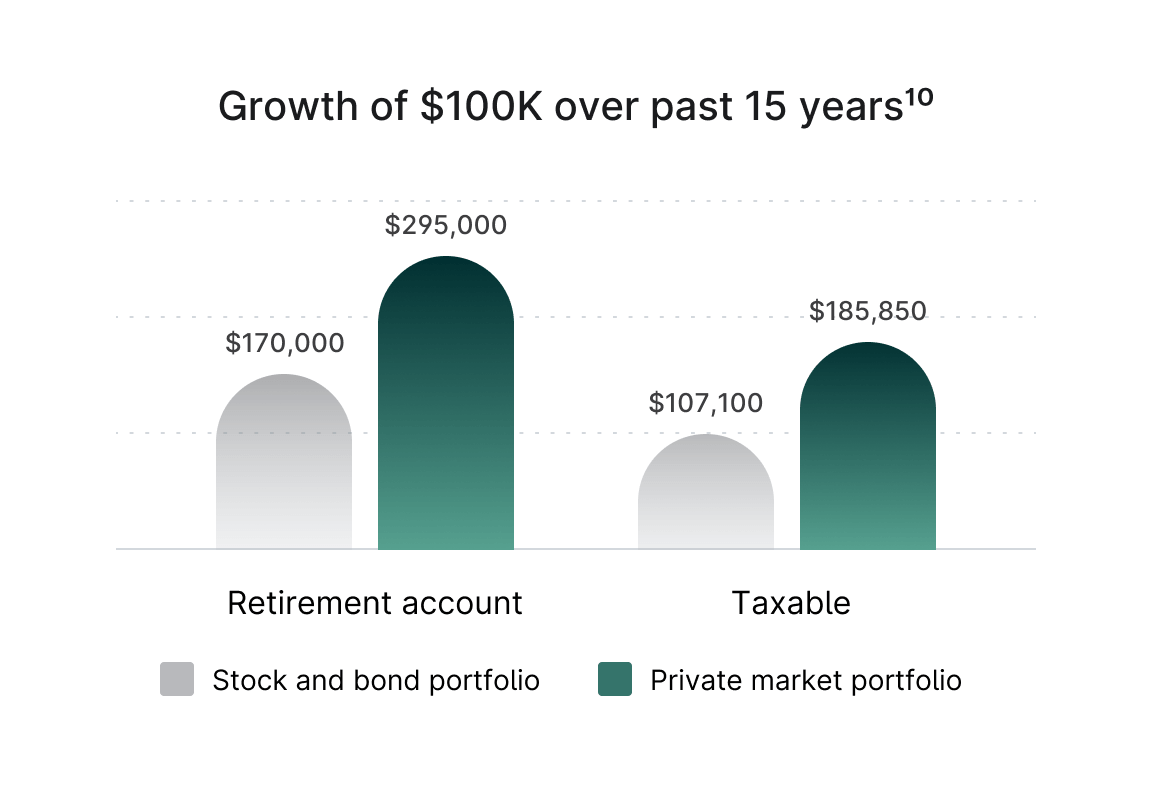

Compound long-term growth

With a generally longer time horizon, a retirement account can be ideal to let less-liquid private market assets target higher risk-adjusted returns.

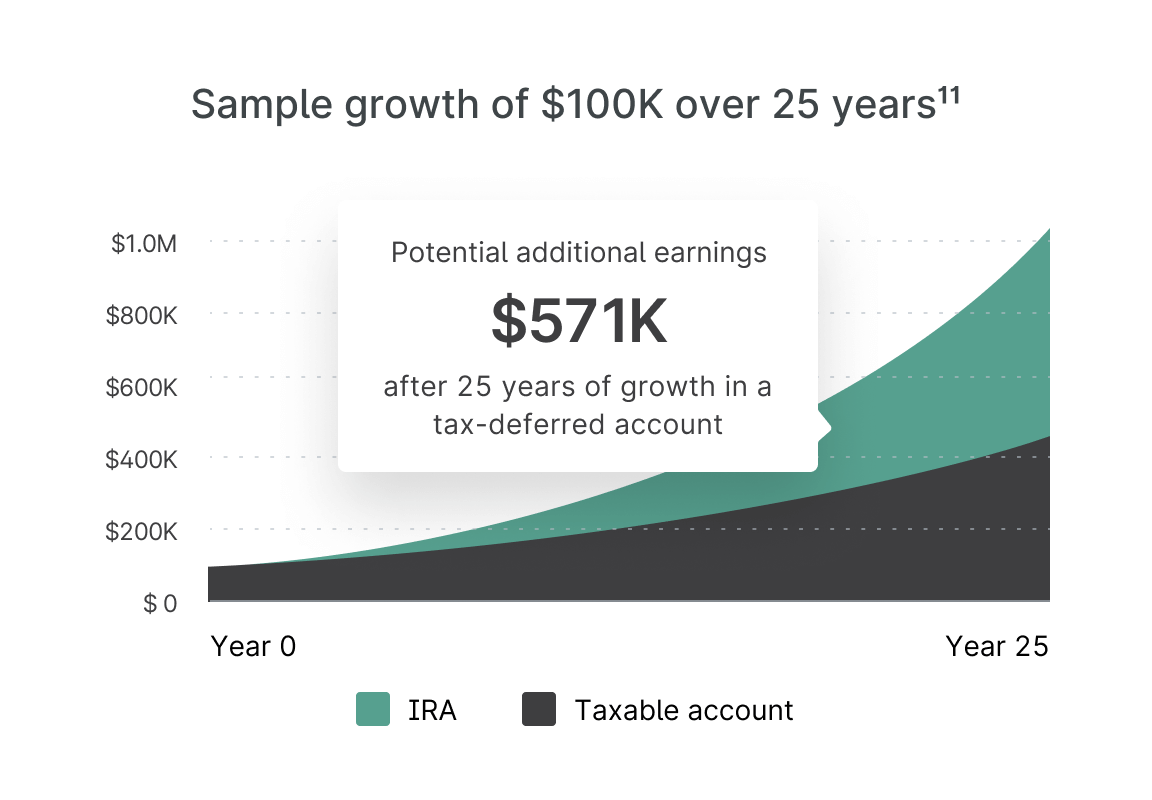

Keep more of what you earn

Instead of realizing income or capital gains each time a private market investment matures, let it compound with tax advantages in a retirement account.

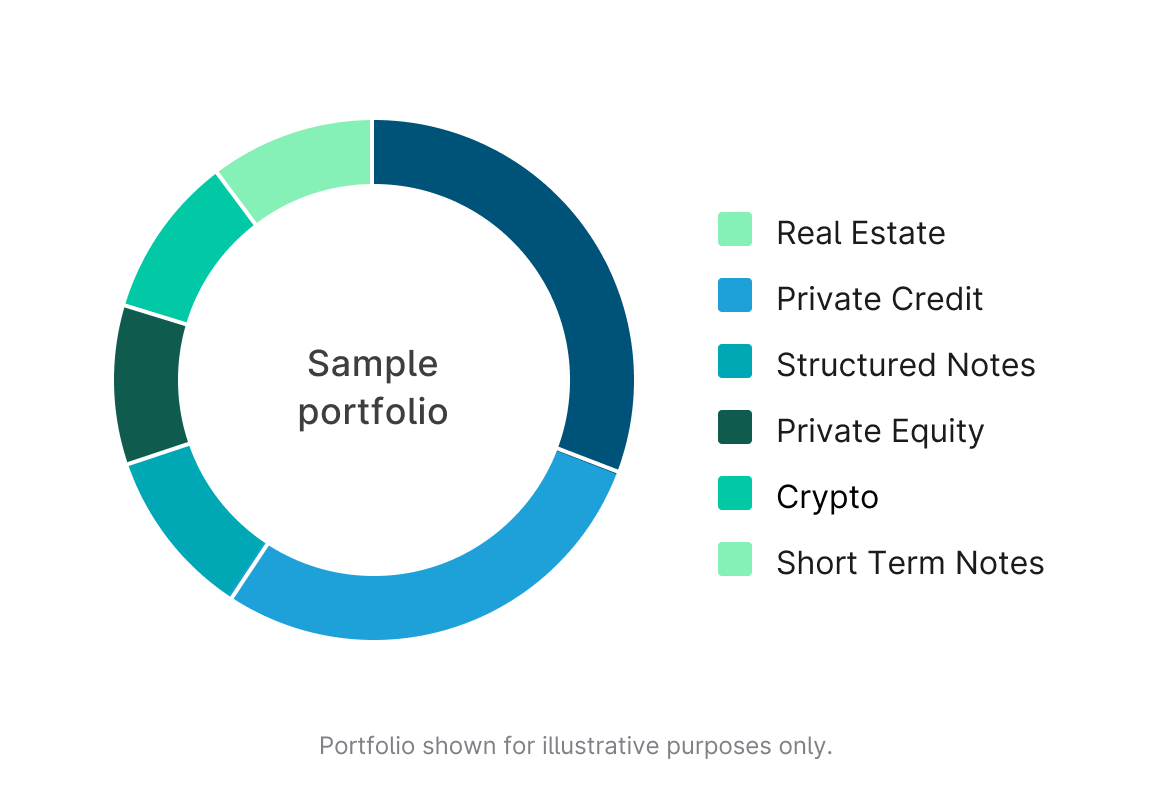

Extensive opportunities, one platform

We’ve developed innovative structures that unlock previously restricted investments for IRAs. More than 85% of our investments are available to retirement accounts.

Real Estate

Private Credit

Private Equity & Venture Capital

Funds Investments

Short Term Notes

Structured Notes

Reserved access to offerings

Gain access to some of our highest-demand investments, such as our Supply Chain Financing program, with reserved funding for retirement accounts.

Powered by a top IRA account custodian

We offer a best-in-class retirement investing experience through Equity Trust, one of the largest self-directed IRA custodians in the U.S.

$45B+

in assets under custody and administration"Best overall"

self-directed IRA company¹²50

years in businessGet started in 5 minutes

We’ve made adding private markets to your retirement account nearly as easy as traditional public market investments.

1

Open an account

Create an Equity Trust account directly through Yieldvilla.

2

Roll over or transfer funding

Equity Trust’s concierge team will help you transfer or roll over funding to your account.

3

Add investments

You’re all set to invest in Yieldvilla offerings with your retirement account.

Reduced fees with Yieldvilla

Yieldvilla members enjoy reduced Equity Trust account fees. Pay as little as a 0.09% annual fee based on your retirement account balance.